When it comes to protecting our furry family members, nothing matters more than peace of mind. That’s why extensive pet insurance for accidents and illness is so important—especially when life throws the unexpected your way.

At Knose, we’re proud to be multi-year award winners from the likes of Mozo and Canstar—two of Australia’s most trusted consumer finance platforms.

But beyond the accolades, what exactly makes pet insurance great? And what should pet owners look for when choosing the right cover?

Here are the best practices for accident and illness coverage—and how Knose continues to set the standard for pet care in Australia.

1. Great value for accident and illness pet insurance

Pet insurance should strike the perfect balance between affordability and coverage. As Mozo puts it:

“A great price and cover for the unexpected can be great peace of mind for Australian pet owners.”

— Mozo

Choose a pet insurance policy that offers genuine benefits at a competitive price—true value for money. Knose was recognised by Mozo for doing exactly that, with our Accident & Illness cover standing out in a comprehensive assessment of quotes across the market for its exceptional overall value.

2. Comprehensive routine care options for pets

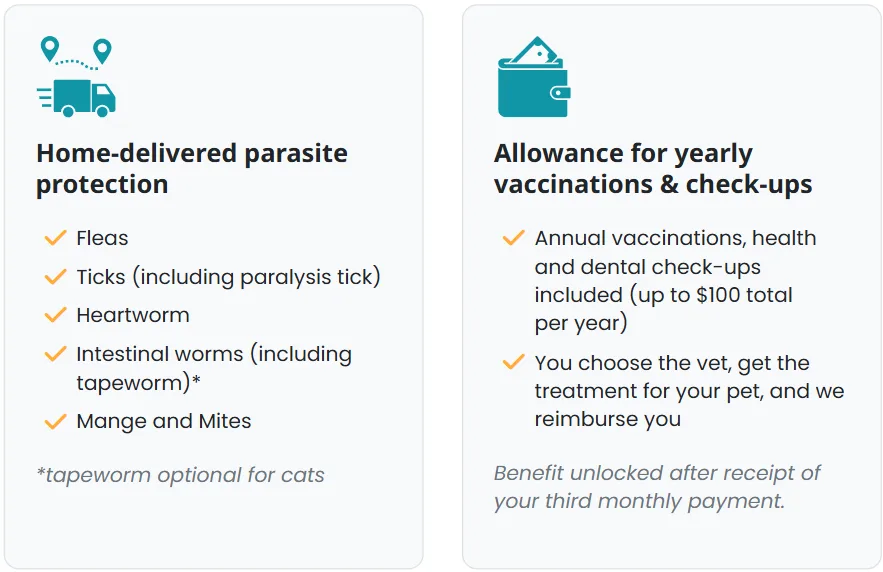

Good pet insurance covers the unexpected accidents and illnesses—but proactive care is just as important. That’s where the Knose Pet Care Plan comes in.

It’s a simple, all-in-one wellness subscription designed to help you stay on top of your pet’s everyday health needs.

Pet care plans are a cost-effective way to maintain your pet’s health regime. Not only do they spread the costs throughout the year to help with budgeting, they are also super convenient.

Knose was recognised by Canstar for our Accident & Illness with Routine Care cover. Our policy ticks all the boxes Canstar looks for—including a high annual benefit ($10,000+), 80%+ reimbursement rates, and comprehensive preventative care options.

3. Transparent coverage for accidents and illnesses

Pet insurance should be clear, trustworthy, and there when you need it. You shouldn’t have to decode fine print, chase vague inclusions, or wonder what’s covered and what’s not.

Simplicity builds trust, saves time, and gives you confidence to make quick, informed decisions about your pet’s health.

At Knose, we believe that pet care should be easy: no jargon, no sneaky exclusions, and no unnecessary complexity.

Just honest cover, transparent policies, and real support—so you can focus on what matters most: your pet’s health and happiness.

4. Flexible pet insurance for every pet

Your policy, your terms! Pet insurance should offer customisable coverage options—tailored solutions that meet the diverse needs of Aussie pet owners. Here are our examples:

Customisable cover levels

Pet owners can shape their policy by choosing:

- Annual benefit limit

- Reimbursement rate (70–90%)

- Annual excess

This empowers Knose members to balance premium costs with the level of protection they want.

No sub-limits or hidden cost

Knose policies do not impose sub-limits on specific treatments or categories, simplifying claims and giving customers full access to their selected annual limit.

Optional add-ons for expanded protection

Knose offers optional extras that can be added for a more tailored policy:

- Dental illness cover: Treats conditions like periodontal disease and gingivitis.

- Behavioural problems cover: Includes therapy for anxiety, overeating, or compulsive behaviours.

- Specialised therapies: Covers physiotherapy, acupuncture, and hydrotherapy.

You’re in control—build the plan that suits your pet’s needs and your lifestyle. This adaptability is a big reason why we keep earning awards year after year.

5. Easy claims and exceptional customer support

When a pet becomes ill or injured, the last thing a pet owner needs is a complicated or delayed claims experience. Transparent, and hassle-free claims not only ease emotional and financial stress, but also foster trust.

Similarly, having access to knowledgeable, compassionate support can help pet owners make informed decisions quickly during emergencies.

For this reason, Knose members get access to the Knose Pet Health Hotline—a 24/7 phone service staffed by qualified vet nurses. Whether it’s late-night symptoms, policy concerns, or general health advice, pet owners can speak directly with a professional anytime.

Recognised by the best in Australia

Being recognised by trusted consumer finance platforms like Mozo and Canstar is more than just a badge of honour—it’s a reflection of Knose’s commitment to delivering exceptional pet insurance.

These awards are based on thorough, independent assessments of value, coverage, flexibility, and care—all areas where Knose consistently stands out.

By earning these accolades across multiple years, Knose has proven itself as a true champion in Accidents and Illness Pet Insurance, trusted by experts and loved by pet parents across Australia.

These awards aren’t just nice to have—they’re proof that we’re delivering on our promise to Aussie pet parents.